| StockFetcher Forums · Stock Picks and Trading · Your thoughts on trend change on AMBA. | << 1 2 >>Post Follow-up |

| Mactheriverrat 3,178 posts msg #134105 - Ignore Mactheriverrat modified |

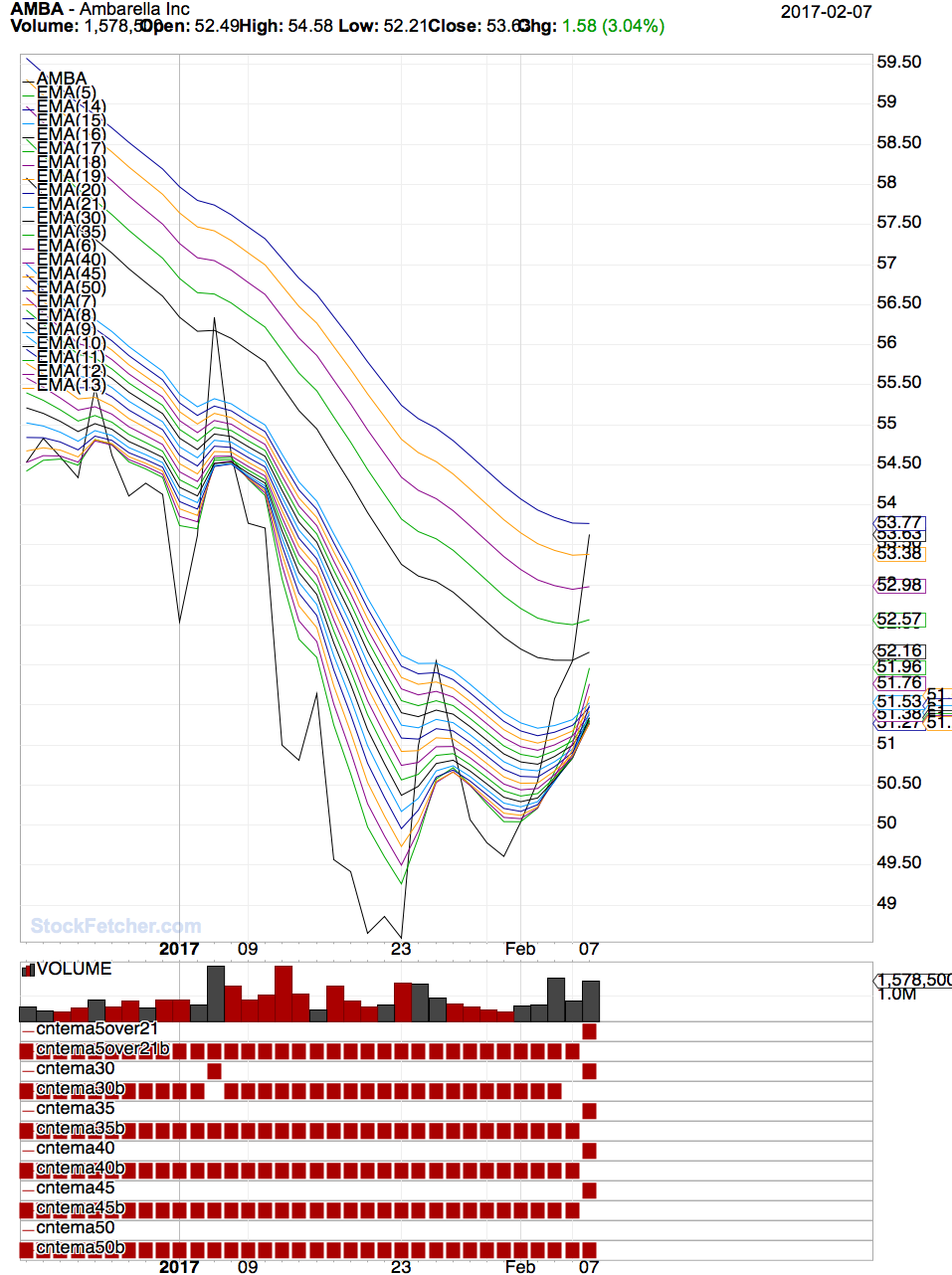

2/7/2017 5:43:41 PM Your thoughts on trend change on AMBA going from downtrend to uptrend.  |

| gmg733 788 posts msg #134106 - Ignore gmg733 modified |

2/7/2017 6:12:13 PM I'll take a stab. Still down. How long? No idea. Maybe it fills that 43ish gap. Maybe it goes to support at 35. Maybe it gets bought out tomorrow and hits 100. However, you shouldn't care what I think. I can give you 5 reasons why I think it will go down. But if it goes up did it matter. :) I'm not trying to be a jerk. When I stopped caring what others thought my trading improved. Trust yourself. |

| pthomas215 1,251 posts msg #134108 - Ignore pthomas215 |

2/7/2017 8:58:35 PM I like it mac. I think tomm you might be able to pick it up mid morning for a better price than the close today. |

| Mactheriverrat 3,178 posts msg #134110 - Ignore Mactheriverrat |

2/8/2017 1:56:35 AM Big Thanks for all input- Reason I'm asking is I'm studying stocks that the EMA(5) that has crossed above the EMA(21) and the Price that crossed above the EMA(13) and has already had a EMA(4) cross above EMA(8).  |

| Mactheriverrat 3,178 posts msg #134111 - Ignore Mactheriverrat |

2/8/2017 3:09:06 AM AMBA Short term EMA's moving longer term EMA's upward already - Strength to the Bullish Upside - IMHO!  |

| pthomas215 1,251 posts msg #134112 - Ignore pthomas215 |

2/8/2017 9:00:11 AM mac I was playing with some of the guppy stuff too. do you usually get good results when you have the ema (13) above ma(20)? |

| johnpaulca 12,036 posts msg #134113 - Ignore johnpaulca |

2/8/2017 9:22:23 AM AMBA($53.63).....one close above a breakout doesn't constitute a change in sentiment. Breakout area needs to be re-tested first and stick then you would call that a change in sentiment. How many times have you bought a breakout just to watch it reverse and leave you holding the bag. AMBA is a vicious trading stock, lots of manipulation in this one so be careful. |

| Mactheriverrat 3,178 posts msg #134138 - Ignore Mactheriverrat |

2/8/2017 9:57:59 PM AMBA just on watch list for now. Its all about their earnings date of 2/28 and how traders play up date.  |

| nibor100 1,102 posts msg #134164 - Ignore nibor100 |

2/9/2017 12:23:58 PM Looking at the AMBA chart history, it appears that once price goes from below the EMA 21 to above it, and DI+(14) crosses above DI-(14) there will usually be, at minnimum, a several day long uptrend. In this instance that occurred the day before your first post, so we are in the 3rd or 4th day of the uptrend run depending how one looks at it. Ed S. |

| Mactheriverrat 3,178 posts msg #134170 - Ignore Mactheriverrat modified |

2/9/2017 2:01:47 PM The best to me is when the ema(5) goes above ema(21) but the short term ema averages should be doing a good rolling over each other. We will see how this thing plays out.  |

| StockFetcher Forums · Stock Picks and Trading · Your thoughts on trend change on AMBA. | << 1 2 >>Post Follow-up |