| StockFetcher Forums · Stock Picks and Trading · Random musings of a Virgin(wanna be)Trader | << 1 2 3 4 5 ... 8 >>Post Follow-up |

| xarlor 641 posts msg #154293 - Ignore xarlor |

10/12/2020 11:26:07 AM- SP500 performance 3 months before the votes are cast apparently (100% accuracy since 1984) points to the incumbent winning if it is positive.

Careful with these types of predictions. From 1984 to 2016, you're talking about a sample size of... 9. If we only count elections that include a president running for a second term, the sample size drops to 5. Interesting, yes. Statistically significant, no. |

| shillllihs 6,102 posts msg #154296 - Ignore shillllihs |

10/12/2020 1:16:11 PM Yup Mac. On the Spy finance board they were yapping all last week that the market would tank. Some are paid bashers with multiple ids & others are small time option traders and robinhooders and look at the market now. You can enjoy politics but know that it’s just a show, kind of like when I was a kid and my grandfather would cheer the Bruiser & The Crusher on all star wrestling. |

| VirginTrader 73 posts msg #154297 - Ignore VirginTrader |

10/12/2020 3:29:48 PM @xarlor absolutely you are correct. hence, "fun" things to ponder/wonder and look back ... Talking about "statistically significant" things... Question for you and anyone visiting the thread: what indicator is your "fave" that produces consistent outcomes for you? TY For example...TRO seems to like RSI2, snappy likes the Stock 20/40, Mac likes Guppy, etc... |

| xarlor 641 posts msg #154298 - Ignore xarlor |

10/12/2020 5:41:21 PMwhat indicator is your "fave" that produces consistent outcomes for you?

For swing trading stocks, I'm partial to Larry Connors' systems. His books are a good read and the systems are highly mechanical. Takes emotion and guesswork out of trading. Enter when signals flash, exit when signals flash. Swing Trading with Larry Connors |

| VirginTrader 73 posts msg #154368 - Ignore VirginTrader |

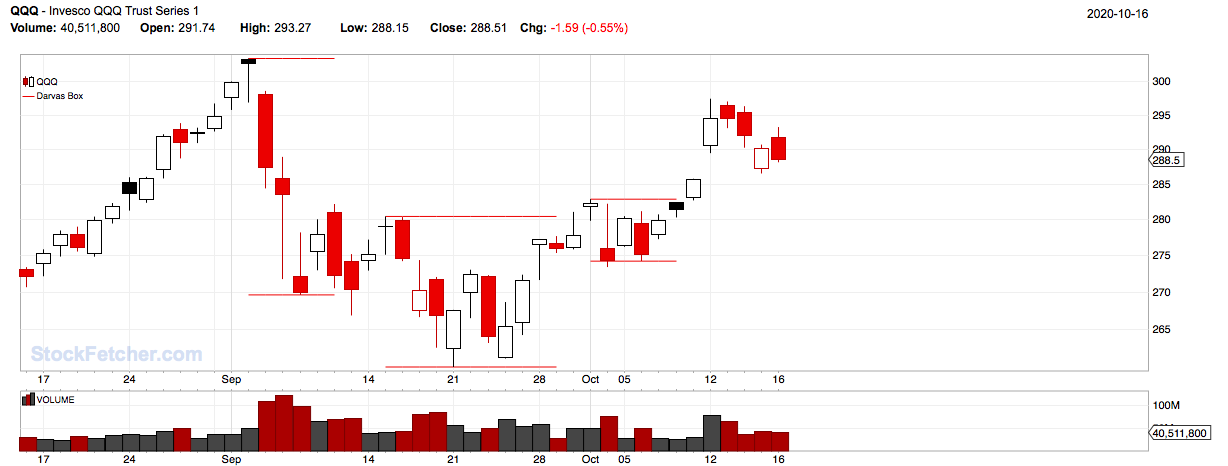

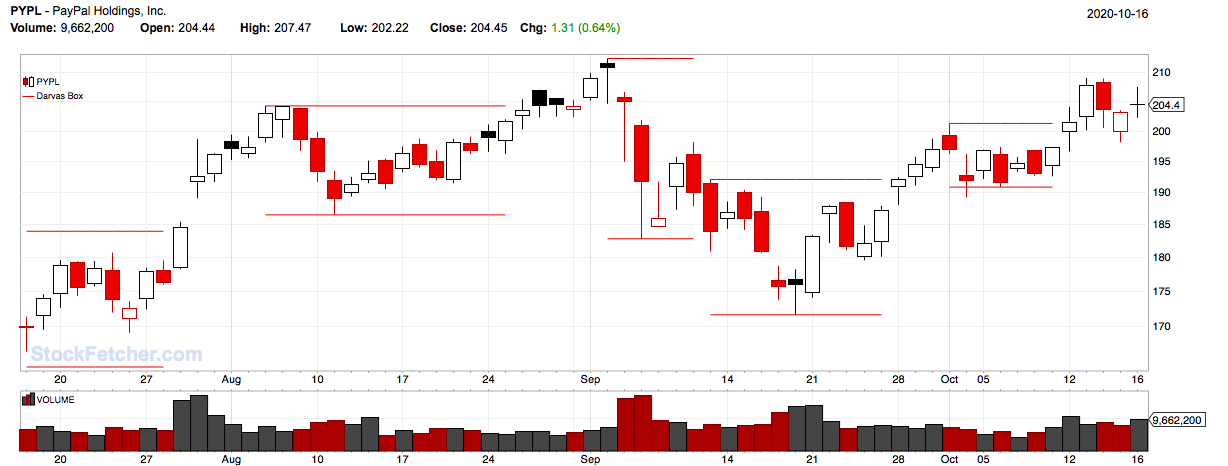

10/19/2020 8:55:04 AM OSTK is down 7% for the week QQQ is up less than 1% (great Monday and faded out during the week). Picked up PYPL $204.45 and ZM $559 According to IBD/TIPP polls Biden at 49.5% vs 44.5% for Mr. T. So far, no fireworks!     |

| VirginTrader 73 posts msg #154421 - Ignore VirginTrader |

10/24/2020 10:28:29 AM IBD poll: Biden 49.8 vs Mr T 45.2. No one delivered a knockout blow during the last debate. No fireworks so far... OSTK -11% QQQ - flat ZM - 8% PYPL - flat Feels like a holding pattern till after the election results come out... |

| Mactheriverrat 3,178 posts msg #154422 - Ignore Mactheriverrat |

10/24/2020 1:59:21 PM Polls mean nothing! |

| VirginTrader 73 posts msg #154423 - Ignore VirginTrader |

10/24/2020 3:56:54 PM @Mac...we all saw what happened with Clinton vs Trump. Ain't over till it is over! So far, 3 weeks leading towards the election...the market drifted sideways. you get the bump ups and then it fades. |

| shillllihs 6,102 posts msg #154424 - Ignore shillllihs |

10/24/2020 5:31:09 PM That’s why I said a month ago that there will be side ways action. Sideways action is good for awhile then you want to mix it up. Could be a crazy move coming this week. |

| VirginTrader 73 posts msg #154427 - Ignore VirginTrader |

10/25/2020 7:49:17 AM @shils...correct, that sentiment seems prevalent. There must be a ton of $$ sitting on the sidelines. Given the Feds have telegraphed the need to keep key rates close to zero till 2023 (plus $3+ trillion in deficit and treasury debt up to the ying yang), where will these be deployed? In hindsight, I would should have sold ZM after the pop instead of thinking it would continue to run (trading it) instead of "liking" the stock. PYPL popped and faded (again, I didn't sell; short of my at least 15% target). 15% loss trigger was what I had in mind. Interestingly enough UVXY $16.72 hasn't perked up during the recent shake and bake action. |

| StockFetcher Forums · Stock Picks and Trading · Random musings of a Virgin(wanna be)Trader | << 1 2 3 4 5 ... 8 >>Post Follow-up |