| StockFetcher Forums · Stock Picks and Trading · Picks and Pans Since Jan 2020 | << 1 ... 11 12 13 14 15 ... 29 >>Post Follow-up |

| Nobody 404 posts msg #151858 - Ignore Nobody |

4/17/2020 11:14:17 AM sandjco thanks |

| shillllihs 6,102 posts msg #151859 - Ignore shillllihs |

4/17/2020 12:06:05 PM I would add sell lower on false entries and sell upper band too, that way you can maybe take 80% off the table at top and let 20% ride till it hits median. |

| sandjco 648 posts msg #151866 - Ignore sandjco |

4/17/2020 3:11:36 PM

Thanks to Mac for pointing out postimage website to upload pics. GILD monthly chart. Cup and handle? "W" forming with break of $90? |

| sandjco 648 posts msg #151867 - Ignore sandjco |

4/17/2020 5:32:40 PM @shill.. LOL I admire how that mind of yours works! It seems to work as you are not really "committing" being fully long biased or short biased - not an easy thing to master when it comes to trading (for me anyhow). Also, being happy to "scalp" a few points and be in an out is also another skill i need to add to my arsenal. |

| shillllihs 6,102 posts msg #151868 - Ignore shillllihs |

4/17/2020 8:04:32 PM I learned that sports betting, never fall in love with a team. You don't want to lose too much on entry and you don't want to give it back on the back end so better to scale out, there's always another trade developing. Nothing worse than holding for weeks and losing 70% on the last day. |

| sandjco 648 posts msg #151871 - Ignore sandjco |

4/18/2020 1:03:35 AM Ah..."thinking in bets". four shared that book with me in 2018 and profoundly shifted some of my assumptions (and working on the rest!) "If you credit ALL wins to your SKILLs and ALL losses to bad luck...you will never learn and never improve". Still working on: - adding the "ability" to "scalp" (I am defining it as "in and out" during the day) AND be able to do it without looking back. - adding the "ability" to go long or short regardless of how "good" a stock have been for me over the years (i.e. should have zero qualms in shorting TSLA or AMZN or AAPL or....i.e. never fall in love with a "team") - be able to "marry" my gut instincts and signals; learn to filter the "noise" in my own way ... - not deviating from the trading plan So weird to see its almost 3 yrs being here at SF.... - I remembered being so impatient the 1st few months thinking there must be a "best" this and "best that" indicator etc.... - thinking that it would be "cool" and profitable to find and code a system that works in every weather.... - should be a piece of cake...can't be that much info in these forums (as I ever wrong...seems like something pops up that makes u go hmmmmm... I know I have changed immensely and learned because of all the contributors here. I am thankful every day for that and for stumbling to this site! SPXL has doubled; never hit my stop...moving up the stop. Thanks again four for the idea of scaling into winning positions (vs. me scaling in on losing positions). IWM Jan 104C in at $13 is now $25; closed. four 5,087 posts msg #136542 - Remove message 6/27/2017 10:43:57 PM My plan was to "build" the position -- We have had a bull market over the last years. Adding to a down hill slide during a bear is possibly expensive. |

| sandjco 648 posts msg #151873 - Ignore sandjco |

4/19/2020 10:19:20 PM Hmmm what can I replace the RSI2 with... |

| sandjco 648 posts msg #151874 - Ignore sandjco modified |

4/20/2020 7:31:55 AM Tinkering around... |

| sandjco 648 posts msg #151878 - Ignore sandjco modified |

4/21/2020 11:56:45 AM Uh oh?  Big name tech earnings next week....taking the mkt a bit higher to suck people in and then off the ledge? |

| sandjco 648 posts msg #151880 - Ignore sandjco modified |

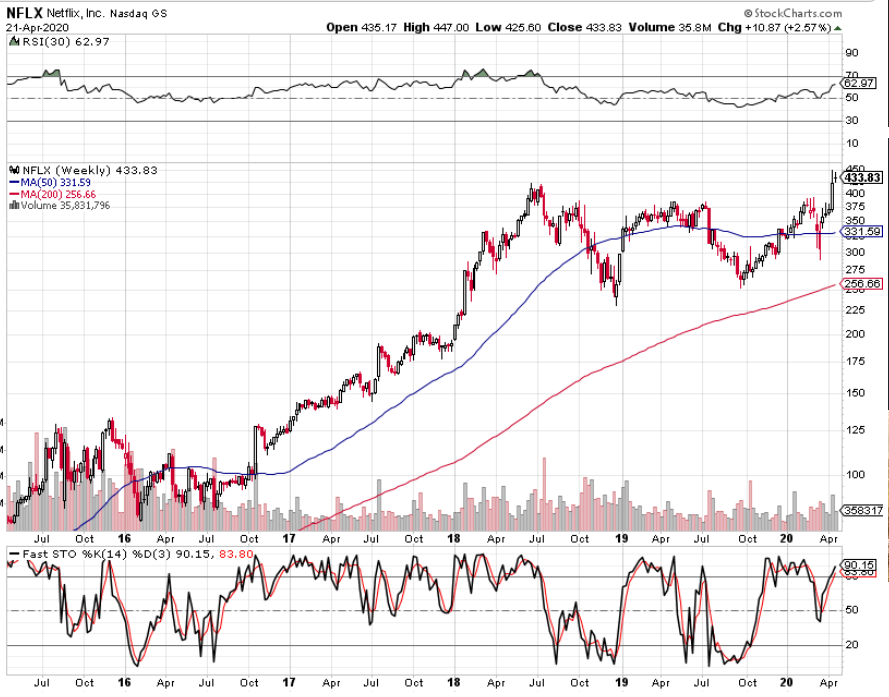

4/21/2020 10:24:38 PM NFLX earnings day...traded flat relatively speaking while the market crapped. What will tomorrow bring?  Made new 2 year high? Ascending triangle?  |

| StockFetcher Forums · Stock Picks and Trading · Picks and Pans Since Jan 2020 | << 1 ... 11 12 13 14 15 ... 29 >>Post Follow-up |