| StockFetcher Forums · Stock Picks and Trading · GameStop Do you have a filter that found it? When? | << 1 2 3 4 >>Post Follow-up |

| Mactheriverrat 3,178 posts msg #155533 - Ignore Mactheriverrat |

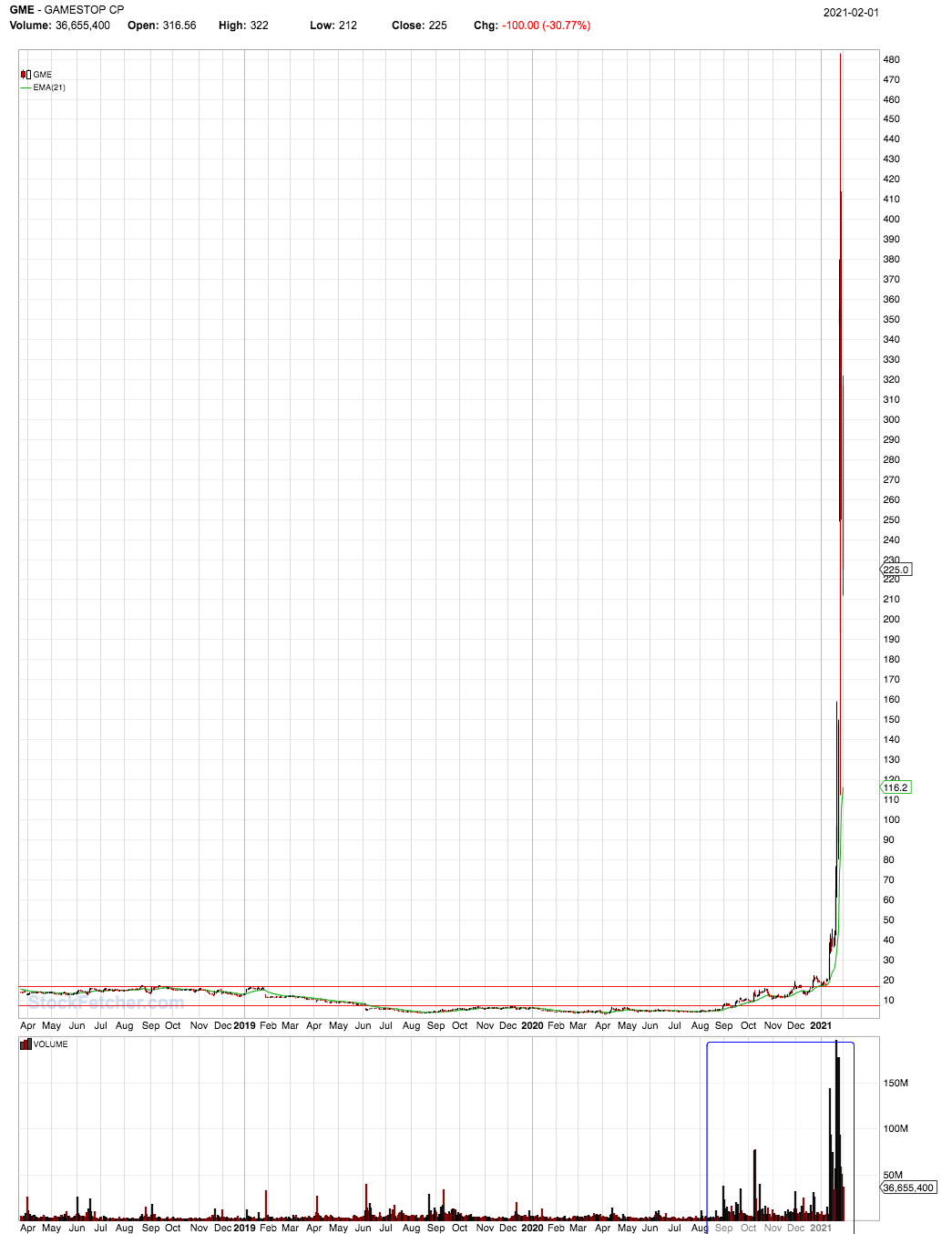

2/1/2021 11:06:01 PM Not that one can keep any alerts of SF but GME could have been alerted to someone . Broke first resistance line and price made some big above 4% gains early on . Then add above average volume days sure caught some eyes Two base breakouts ! Then add in the Reddit pumpers and I'm sure there were a lot of winner's in the scheme of things. Good for all the winner's. Now the media talking heads and the idiots in Washington will some how find fault and try to Blame someone or some group.  |

| nibor100 1,102 posts msg #155537 - Ignore nibor100 |

2/2/2021 10:12:23 AM @Mac, What does this mean in your last post? "Not that one can keep any alerts of SF" Thanks, Ed S. |

| nibor100 1,102 posts msg #155538 - Ignore nibor100 |

2/2/2021 10:24:20 AM @gmetzl, Thanks for posting your filter. I notice that you have increased the lower price limit from $1 to $2 since your first post of your filter for high volatility penny stocks and the upper price limit also, What was your reasoning for those changes if you don't mind? Ed S. |

| nibor100 1,102 posts msg #155540 - Ignore nibor100 |

2/2/2021 10:34:09 AM @miketranz, I do want filters posted that found GME earlier than last week, but I'm not really hung up on finding pre-Breakout filters as I'm not sure how they would be made to work for placing reasonable trades as some stocks can be pre-breakout for years and others can appear to be pre-breakout and then the company goes under. For this thread, I'm just looking for all filters that found GME in the past 6 months, as I believe it will foster some new thinking/new ideas, etc.for discussion purposes; as the filter I posted at the beginning of this thread and its variations serves me just fine. Thanks, Ed S. |

| Mactheriverrat 3,178 posts msg #155542 - Ignore Mactheriverrat |

2/2/2021 11:26:11 AM @Ed S. Means that SF should and could have markers or resistance line where a user could add a alert. So if price crossed that resistance line or marker the user would get a email alert. John |

| nibor100 1,102 posts msg #155545 - Ignore nibor100 |

2/2/2021 11:49:20 AM @John, I follow you now...I guess the only SF workaround would be to figure out the resistance values for a stock or group of stocks,(which I assume you are already doing), then code them into a filter so that the results only happen for those that cross the resistance value that day, and get the daily filter email from SF with those results if any. Won't be real time but might work for End of Day traders. Thanks, Ed S. |

| nibor100 1,102 posts msg #155546 - Ignore nibor100 |

2/2/2021 11:53:34 AM @Duane, No problem, as Hijacking is fine as I just wanted to spur on some new discussion and new ideas, etc. New projects are good, keeps us mentally active....I think..... Thanks, Ed S. |

| nibor100 1,102 posts msg #155547 - Ignore nibor100 |

2/2/2021 12:25:56 PM Looks like interest is waning in posting filters that found GME, time to start some analysis. Other than the filter I posted others found GME on Dec 22 Dec 30 Jan 4 Jan 7 2 on Jan 11 2 on Jan 13 In the mystery column is the filter that Safetrade posted last night in the Public Filter List thread which first finds GME on May 22, 2019 and virtually everyday thru Sep 15 2020. It appears it finds it anytime GME's price is below $8 but haven't quite figured out the purpose.... Ed S. |

| gmetzl 4 posts msg #155549 - Ignore gmetzl |

2/2/2021 1:47:37 PM @Ed S For the lower limit, I originally had it at $2 because that’s just a comfort level for me. I lowered it to $1 for the previous time I posted it so it would catch more of the stocks the original poster may have been looking for and noted to adjust price to his/her liking. For the upper limit, I used to have it at $20 and a similar filter for stocks over $20, which I was doing for position sizing purposes, however I stopped doing that and arbitrarily chose $50 to have a happier medium. |

| Nobody 404 posts msg #155550 - Ignore Nobody |

2/2/2021 4:11:08 PM Not GameStop - but i did play for a quick hit and run ball game on AMC MONTHLY CONSOLIDATION PATTERN appeared on JANUARY 12 |

| StockFetcher Forums · Stock Picks and Trading · GameStop Do you have a filter that found it? When? | << 1 2 3 4 >>Post Follow-up |