| StockFetcher Forums · General Discussion · XIV | << 1 ... 13 14 15 16 17 ... 22 >>Post Follow-up |

| Mactheriverrat 3,178 posts msg #141727 - Ignore Mactheriverrat |

2/2/2018 2:12:24 AM Is it just me or are the Markets looking for that long term correction that people talk about? |

| pthomas215 1,251 posts msg #141728 - Ignore pthomas215 |

2/2/2018 2:25:16 AM I think price just needed to move closer to home, the moving average 20...through both consolidation and time...meaning some days are just neutral. I do think the bigger 5-10% crater will happen in the next month. |

| Mactheriverrat 3,178 posts msg #141729 - Ignore Mactheriverrat |

2/2/2018 2:55:55 AM Agreed PT on that. |

| Mactheriverrat 3,178 posts msg #141762 - Ignore Mactheriverrat |

2/2/2018 1:44:30 PM Well its wasn't like nobody didn't see this coming.  |

| pthomas215 1,251 posts msg #141766 - Ignore pthomas215 |

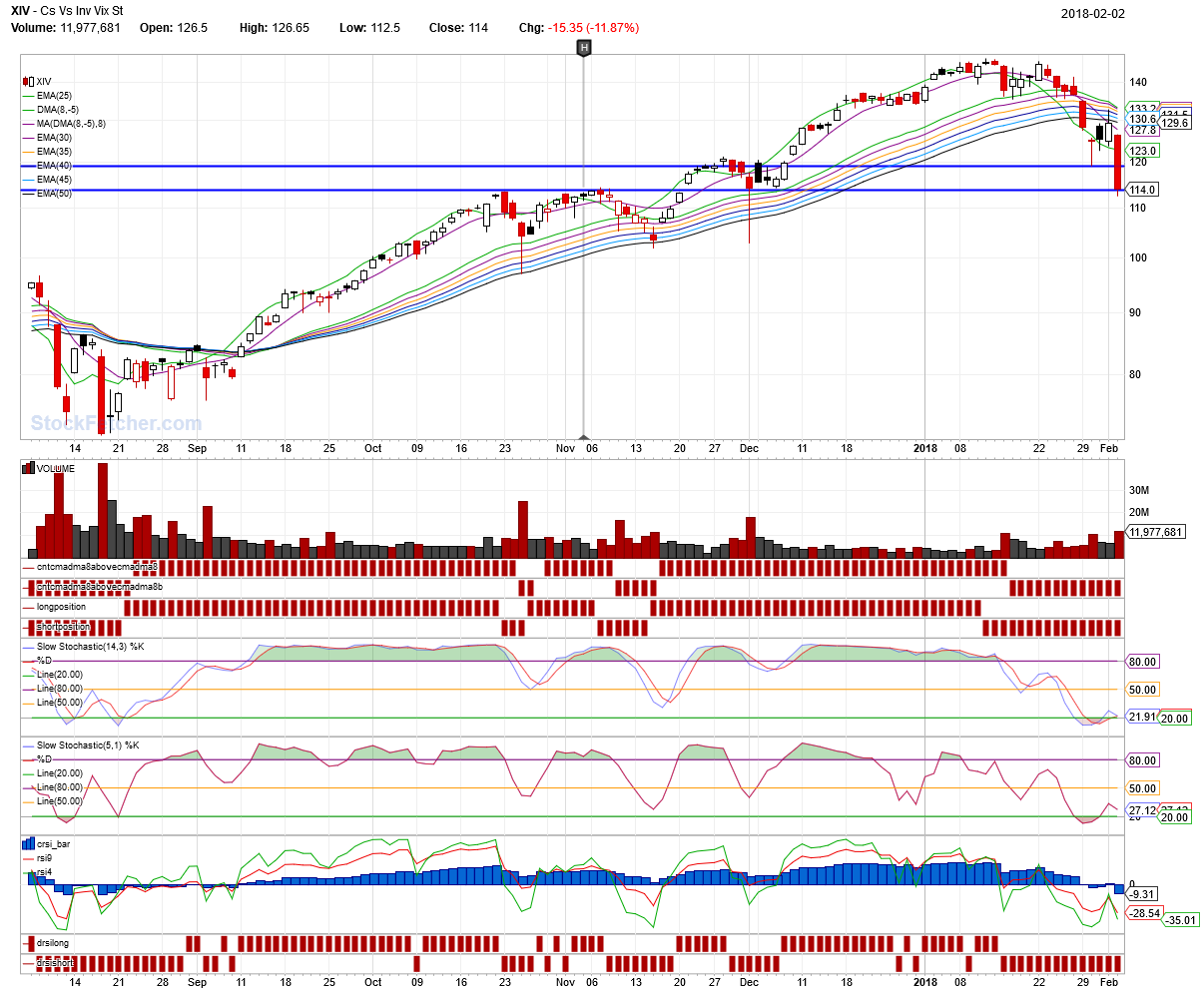

2/2/2018 1:53:31 PM Total sh7t show. XIV will be a screamin buy. you could have also looked at IWM on the charting wealth system to see this coming. Appears to me the 38% retracement from 52 week high is where it might settle. just north of 114. |

| Mactheriverrat 3,178 posts msg #141767 - Ignore Mactheriverrat modified |

2/2/2018 2:01:38 PM Yes PT Not much volume on major indices selloff. To me that says a chance to buy on pullback on xiv and a lot of up trending stocks. Nothing really bad about this Bull market just a good little correction. IMHO! Have a good weekend everyone. |

| Mactheriverrat 3,178 posts msg #141769 - Ignore Mactheriverrat |

2/2/2018 2:10:20 PM Look dia,spy,ndaq,imw all are about average volume. No great crash and burn selloff. Just a chance buying opportunity coming soon. |

| davesaint86 726 posts msg #141779 - Ignore davesaint86 |

2/2/2018 3:43:50 PM |

| Cheese 1,374 posts msg #141787 - Ignore Cheese |

2/2/2018 5:16:33 PM per Eli Mintz, $VIX is in backwardation today Feb 2, 2018 ($VIX futures contango is negative and settles at -4.16%) There is a tail wind for $VXX and $UVXY holders The long term $VIX futures are the best guess of the market at what average volatility will be like going forward. Market believes that going forward, $VIX will be lower than current spot $VIX of 17.31 |

| Mactheriverrat 3,178 posts msg #141801 - Ignore Mactheriverrat modified |

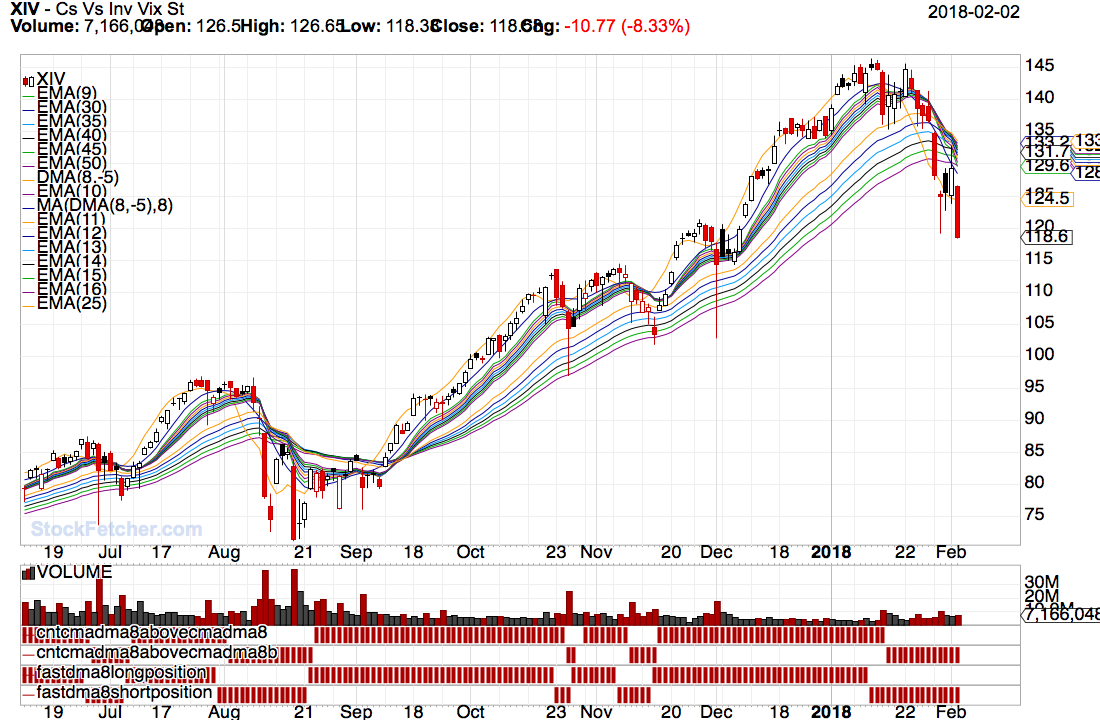

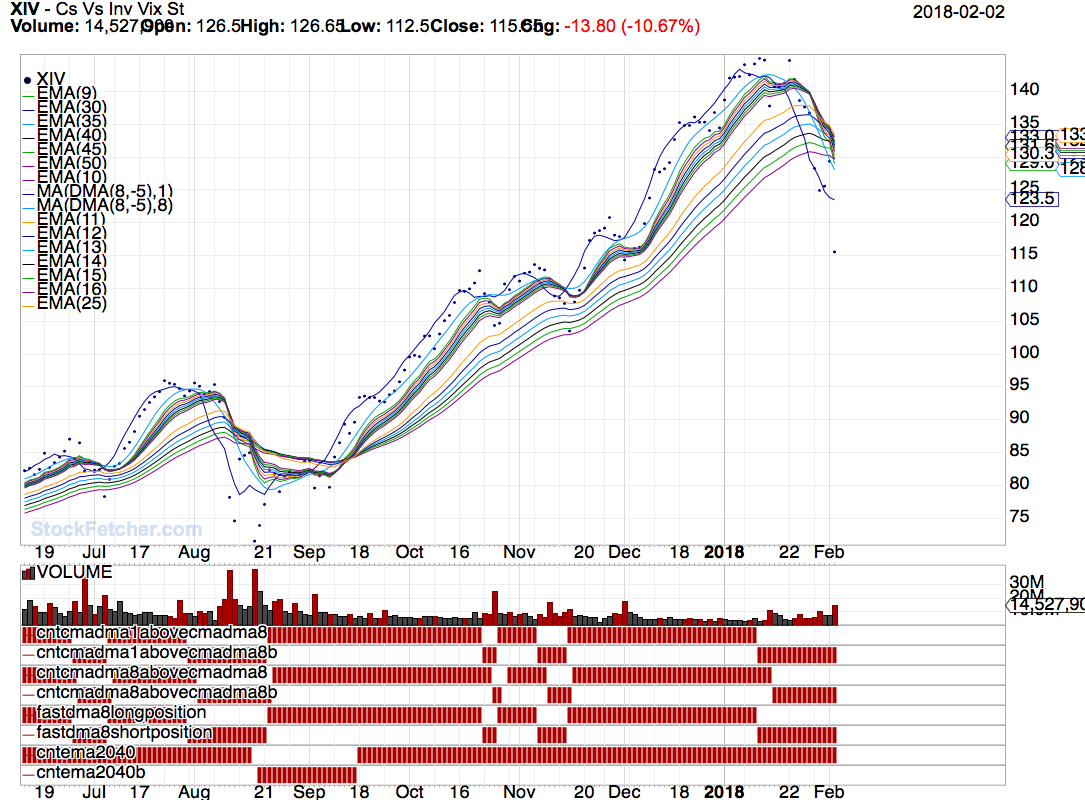

2/3/2018 10:41:59 AM Submit To me this code could be applied to any filter from 13th_floor's deadly combo to TRO's Run Forrest Run to just a filter of S&P 500 stocks as a trigger. Using cma(DMA(8,-5),1) above (+)/below(-) previous cma(DMA(8,-5),8) as the trigger. Just throwing this out there for people to study if they want. |

| StockFetcher Forums · General Discussion · XIV | << 1 ... 13 14 15 16 17 ... 22 >>Post Follow-up |