| StockFetcher Forums · General Discussion · Lots of good setups coming up on scans showing up | << 1 2 3 4 >>Post Follow-up |

| Mactheriverrat 3,178 posts msg #145886 - Ignore Mactheriverrat |

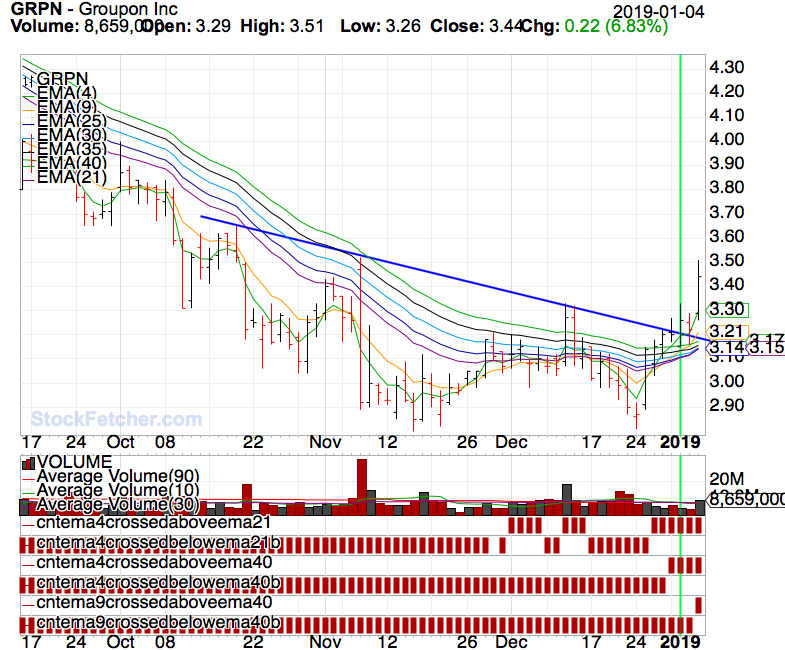

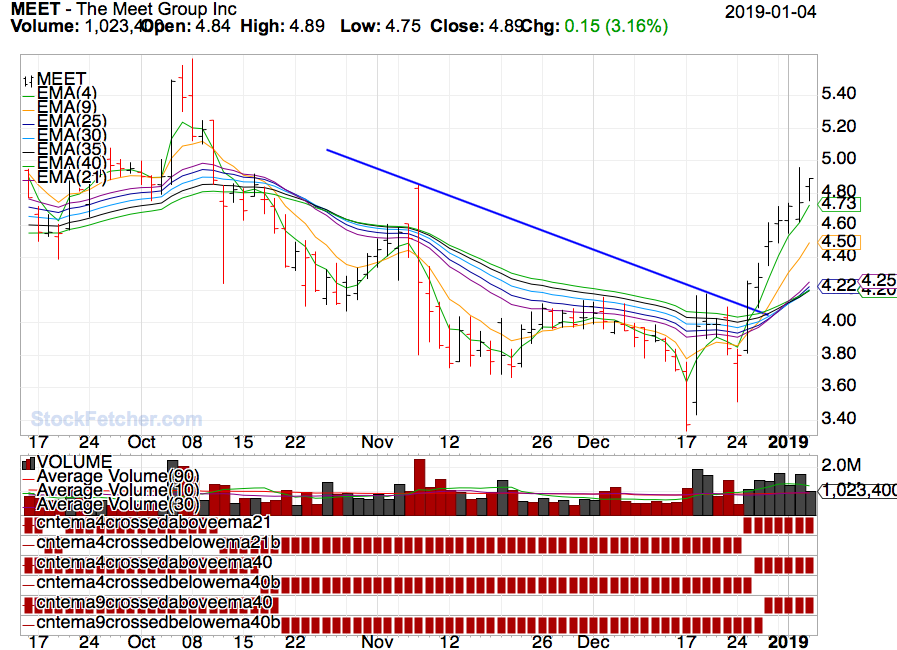

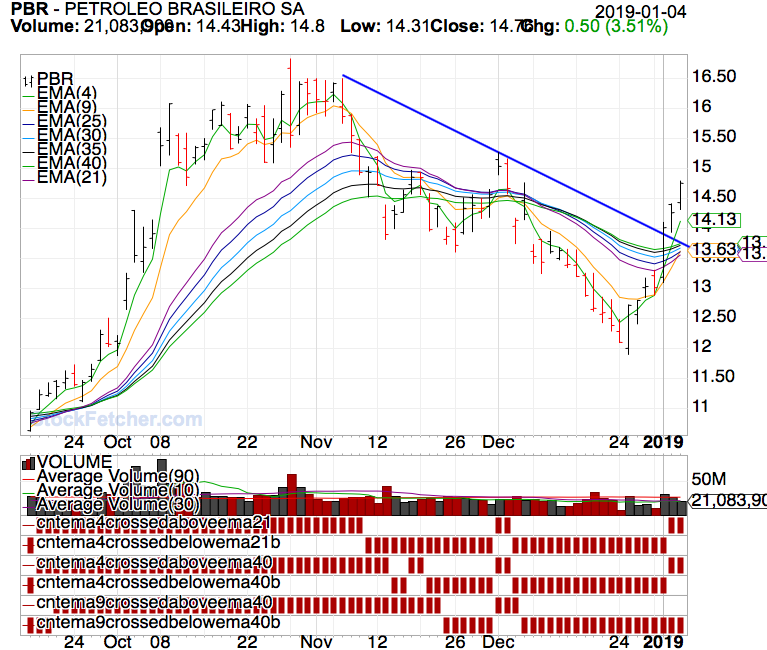

1/6/2019 4:12:59 PM CC GRPN WWE PBR to name a few. |

| ron22 255 posts msg #145887 - Ignore ron22 |

1/6/2019 9:53:48 PM Hi Mac, Which scans are showing these setups? Thanks. |

| Mactheriverrat 3,178 posts msg #145888 - Ignore Mactheriverrat modified |

1/6/2019 11:26:07 PM Its any filter from 13th_floors, TRO and others to name a few. Its the breaking of down trend lines and the turning of the longer term trend line turning up kind of like what happens in Guppy MMA's theory. Submit Fetcher[ /* When the EMA4 cross's the EMA21 which you sort by ema421 by most recent. Draw your downtrend resistane lines. Start watching the longer term ema21,25,30,35,40 turn up. Next Bullish flag will be the ema4 cross above ema40while watching the longer term avarages keep turning up. watch price to see if breaks above downtrend line. the If price breaks above downtrend line, chance's are it will be a breakout. The last ema9 cross above above ema40 takes place and more than not the down trend has changed to a up trend. Longer term averages are turning and and starting to squeeze in a Guppy MMA turn. Also watch out for higer volume as other trader,s buy in too. Bullish! Keep it plain and simple. */ close is between 1 and 100 and ema(4) above ema(21) average volume(90) above 50000 average volume(10) above 250000 add column Average Volume(30) draw Average Volume(30) offset is 0 market is not etf market is not otcbb add column Average Day Range(30) and Average Day Range(30) is above 3.00 do not draw Average Day Range(30) chart-time is 4 months Draw ema(4) Draw ema(9) draw ema(21) draw ema(25) draw ema(30) draw ema(35) draw ema(40) market is not otcbb market is not etf Set{cntema4crossedaboveema21,count( eMA(4) > EMA(21) ,1)} draw cntema4crossedaboveema21 Set{cntema4crossedbelowema21b,count( eMA(4)< eMA(21) ,1)} draw cntema4crossedbelowema21b /* EMA4/21 is number of consecutive days ema(4) above (+)/below(-) previous EMA(21) */ set{421b,days( ema(4) is above eMA(21) ,250)} set{421a,days( ema(4) is below eMA(21) ,250)} set{EMA421, 421a - 421b} and add column EMA421 {EMA421} do not Draw EMA421 Set{cntema4crossedaboveema40,count( eMA(4) > EMA(40) ,1)} draw cntema4crossedaboveema40 Set{cntema4crossedbelowema40b,count( eMA(4)< eMA(40) ,1)} draw cntema4crossedbelowema40b /* EMA4/40 is number of consecutive days ema(4) above (+)/below(-) previous EMA(40) */ set{440b,days( ema(4) is above eMA(40) ,250)} set{440a,days( ema(4) is below eMA(40) ,250)} set{EMA440, 440a - 440b} and add column EMA440 {EMA440} do not Draw EMA440 /* EMA9/40 is number of consecutive days ema(9) above (+)/below(-) previous EMA(40) */ set{940b,days( ema(9) is above eMA(40) ,250)} set{940a,days( ema(9) is below eMA(40) ,250)} set{EMA940, 940a - 940b} and add column EMA940 {EMA940} do not Draw EMA940 Set{cntema9crossedaboveema40,count( eMA(9) > EMA(40) ,1)} draw cntema9crossedaboveema40 Set{cntema9crossedbelowema40b,count( eMA(9)< eMA(40) ,1)} draw cntema9crossedbelowema40b ] |

| Mactheriverrat 3,178 posts msg #145889 - Ignore Mactheriverrat |

1/6/2019 11:30:14 PM SF isn't letting me make it clickable for some reason. |

| Mactheriverrat 3,178 posts msg #145890 - Ignore Mactheriverrat |

1/6/2019 11:36:43 PM     On could even take some of the code and paste it with a symlist of the s&p 500 stocks of the last to years. Its a nice TRIGGER to catch change in trends. |

| Mactheriverrat 3,178 posts msg #145891 - Ignore Mactheriverrat |

1/6/2019 11:39:32 PM Even make a symlist with dia,iwn,spy . The trigger even warned of the crap was fixing to hit the fan back in the start of october. |

| Mactheriverrat 3,178 posts msg #145892 - Ignore Mactheriverrat |

1/6/2019 11:56:25 PM Change some of the code and one would have seem AAPL taking a dump and could have shorted it.  |

| snappyfrog 751 posts msg #145894 - Ignore snappyfrog |

1/7/2019 5:55:30 AM |

| Mactheriverrat 3,178 posts msg #145895 - Ignore Mactheriverrat |

1/7/2019 6:05:13 AM Thanks snappyfrog. I couldn't get the clickable to work last night. |

| ron22 255 posts msg #145897 - Ignore ron22 |

1/7/2019 8:08:09 AM Mac, Thank you for the scan and especially for the explanation on how to use it and why it works. snappyfrog, thank you for making it clickable. |

| StockFetcher Forums · General Discussion · Lots of good setups coming up on scans showing up | << 1 2 3 4 >>Post Follow-up |