| StockFetcher Forums · Filter Exchange · STOCHASTIC CROSSOVER SYSTEM FOR SDS AND SSO | << 1 2 3 4 5 ... 22 >>Post Follow-up |

| Kevin_in_GA 4,599 posts msg #107364 - Ignore Kevin_in_GA |

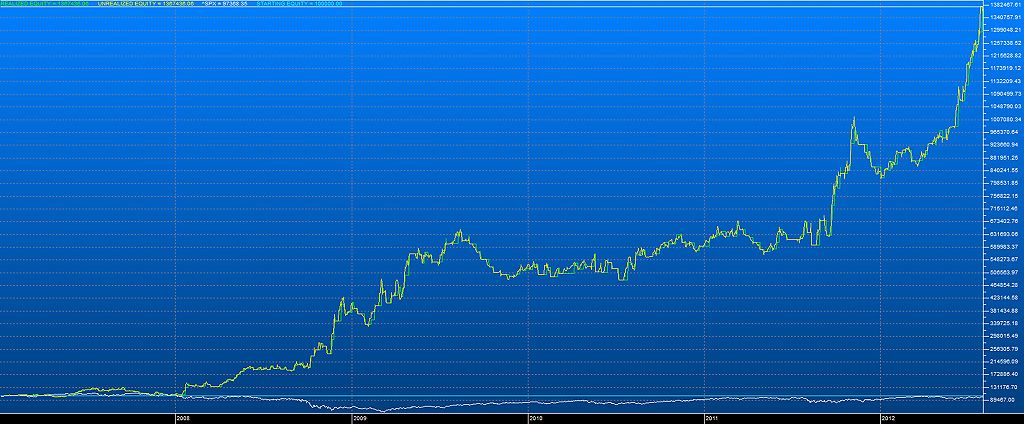

8/5/2012 3:46:22 PM I thought it might be time to start looking at additional market filters based on simple crossover/crossunder behaviors. This filter was the result of several iterations on Stratasearch, starting with the ^SPX, then using leveraged ETFs as trading stocks, and finally to include a trailing stop to provide some form of hazard insurance. Here is how this strategy traded from 1/2/2007 until ths past Friday:

and the stats:

Of note for me is the high monthly Sharpe ratio of 0.4065 (annualized at 1.40). This is unusual given the use of leveraged ETFs - what most people fail to realize is that leverage usually results in a lower Sharpe ratio due to the increased volatility even after the larger gain. Also remember that this included all of the 2008/2009 meltdown. Happy to share this system with folks here. Kevin |

| Kevin_in_GA 4,599 posts msg #107365 - Ignore Kevin_in_GA |

8/5/2012 6:59:09 PM I wanted to confirm these results with the SF backtest data, but for some reason only the SSO trades are showing up. No idea why since this is designed to alternate between SDS and SSO based on their mirror image behavior (the cross below entry signal on SSO corresponds to the cross above exit for SDS, and vice versa). I'll start tracking this here in this thread at the next crossover. |

| novacane32000 331 posts msg #107366 - Ignore novacane32000 |

8/5/2012 8:28:28 PM Kevin ,Thanks. Always exciting when you come up with something new. Have not had a chance to digest this one yet but I like that you incorporated a stop. |

| tombrown1 61 posts msg #107369 - Ignore tombrown1 |

8/5/2012 10:38:51 PM Kevin, Sorry, but I'm not quite understanding this - pardon my ignorance. When STOCHASTICS %D(5,1,5) BELOW STOCHASTICS %D(5,1,10),1 - you go long on either SSO or SDS But then you also short them if it is above? So you are always short one and long the other at the same time? I guess I'm confused by your usage of the word "short". Are you literally meaning to short either of these stocks, or are you meaning "short" to indicate buying into sds? I tried pasting your code into a backtest, and had horrible results for the last two years with your exit and the trailing stop. However, I don't think I'm backtesting correctly because I don't really understand what you're doing. Any help will be appreciated, and if I can understand it a little better then maybe I can be of some assistance in backtesting and optimizing. Best, Tom |

| tombrown1 61 posts msg #107370 - Ignore tombrown1 |

8/5/2012 10:47:46 PM Using this as an entry: SYMLIST(SDS,SSO) STOCHASTICS %D(5,1,5) crosses BELOW STOCHASTICS %D(5,1,10) and your exit of: STOCHASTICS %D(5,1,5) CROSSES above STOCHASTICS %D(5,1,10) or 3% trailing stop over the last two years with 2 maximum open positions and 2 trades per day buying and selling at the open Your equity summary would've lost about $300 total. |

| Kevin_in_GA 4,599 posts msg #107374 - Ignore Kevin_in_GA |

8/6/2012 8:26:37 AM Using this as an entry: SYMLIST(SDS,SSO) STOCHASTICS %D(5,1,5) crosses BELOW STOCHASTICS %D(5,1,10) and your exit of: STOCHASTICS %D(5,1,5) CROSSES above STOCHASTICS %D(5,1,10) or 3% trailing stop over the last two years with 2 maximum open positions and 2 trades per day buying and selling at the open Your equity summary would've lost about $300 total. +++++++++++++++++++ I got bad results from SF as well. Two things worth checking: 1. I only saw that SSO was traded, never SDS. Check to see if SDS was ever traded, and if so was it alternating with SSO as it is supposed to be? 2. If you remove the 3% trailing stop, you get 22% return over the last 4 months on the SSO trades. Again, not sure if the stochastics here are calculated in the same manner as they are in Stratasearch. Also, you should only have 1 position open and 1 trade per day. |

| Kevin_in_GA 4,599 posts msg #107375 - Ignore Kevin_in_GA |

8/6/2012 8:28:11 AM Also, to make it simpler just ignore the "go_short" column, as this is simply to confirm that the mirror image ETF is sending the opposite signal at the same time. |

| Nickster8074 53 posts msg #107381 - Ignore Nickster8074 |

8/6/2012 10:19:02 AM I backtested this filter by hand using the opening price the day following the signal and had some mighty impressive results. The only difference is that I used 3% stop loss as opposed to a 3% trailing stop loss. After commissions, I came up with slightly more than a 51% return from 4/4/12 to 8/3/12, a four month period. It seems quite choppy, but the results speak for themselves. Excellent filter once again Kevin! |

| blumberg 27 posts msg #107383 - Ignore blumberg |

8/6/2012 11:45:24 AM The last four months were extremely choppy, therefore a stochastic crossover system has worked very well. I don't see how it would perform well during a trending market. |

| Kevin_in_GA 4,599 posts msg #107384 - Ignore Kevin_in_GA |

8/6/2012 11:59:05 AM Just look at 2008 for a down trending market and post March 2009 for an uptrend. The graph I posted shows the net equity generated during those times. Both were solid. Nice thing about this filter is a lot of people can use it at the same time and not skew the results, since the liquidity on these two ETFs is insanely high. |

| StockFetcher Forums · Filter Exchange · STOCHASTIC CROSSOVER SYSTEM FOR SDS AND SSO | << 1 2 3 4 5 ... 22 >>Post Follow-up |