| StockFetcher Forums · Filter Exchange · Need help understanding a line of code | << 1 2 3 >>Post Follow-up |

| hmsb4494 81 posts msg #153800 - Ignore hmsb4494 |

8/29/2020 4:58:33 PM can someone please tell me what this line of code is asking for exactly? COUNT(ZSCORE20 BELOW 0,4) ABOVE 3 I understand the first part as zscore20 < 0 for 4 days, but dont understand the above 3 part. from Kevin_in_Ga filter Pangolin z https://www.stockfetcher.com/forums/Filter-Exchange/PANGOLIN-Z-AND-PANGOLIN-W-FULL-SYSTEM-CODE/122431/-1/122431 |

| Cheese 1,374 posts msg #153801 - Ignore Cheese |

8/29/2020 6:02:40 PM @hmsb4494 I'm not 100% sure but I think the COUNT(ZSCORE20 BELOW 0,4) part counts one instance of Z score below 0 for the last four days in a row and the ABOVE 3 part means we'd want 4 or more of such instances. On a separate note, if you or anyone has had success in using Kevin_in_GA or TRO z-score, please elaborate and enlighten me. In my limited experience with z-score, it seemed to be a hit and miss, but that was probably due to my limitation. Thanks. |

| nibor100 1,102 posts msg #153802 - Ignore nibor100 |

8/29/2020 6:02:45 PM The count part of the statement is counting each day of past 4 days it's true, the above 3 part of the statement insures only stocks that have total count of 4 out of 4 are chosen. Ed S. |

| hmsb4494 81 posts msg #153804 - Ignore hmsb4494 modified |

8/29/2020 7:57:16 PM Thanks Cheese and Ed S. Cheese, The original filter calls for an exit of reversersi(2,90). I cannot day day trade because of a day job. But, I trade daily. Buying at the close the stocks from Kevin's filter, and using the ma(5) for an exit. In and out as quickly as possible. Not sure how to use the back tester here on SF, but my trade accuracy over the last 3 months is about 78%. Average gain about 2%+-. I do not use a stop loss and yes I sometimes get walloped waiting for the ma(5) to exit, but I have not been able to come up with a stop loss that did not hurt performance. My account is growing with the occasional ugly draw down. Sometimes there are not any hits on the filter, and I have been playing around with the code I asked you about to get hits. Not sure how that will affect performance. Also, I changed the rsi(2) > 15 to rsi(2) > 5, and I sort by lowest rsi(2). That way i can just buy at the close instead of waiting until reversersi(2,5) for an entry. Sorry so long winded. |

| Cheese 1,374 posts msg #153805 - Ignore Cheese |

8/29/2020 9:25:23 PM @hmsb4494, A BIG THANK YOU for sharing your trading approach. Since you've found a successful trading approach that fits you, your personality, and your work life, I think you may want to stay with it. It is said that 97% of traders lose money, so you are already in the top 3%. The only thing that I would like to suggest is Kevin's money management post. https://www.stockfetcher.com/forums/Filter-Exchange/VOLATILITY-BASED-STOP-LOSSES-AND-POSITION-SIZING/117617/-1/117617 VOLATILITY-BASED STOP LOSSES AND POSITION SIZING Kevin_in_GA modified 1/6/2014 12:32:52 PM In my experience, it seemed quite good. In his example, Kevin set his risk at $1,000. When I used it, I always had to be very honest to myself. Will I really wait until $1000 to take a loss? From my readings, many experienced traders seem to prefer taking a loss of $300 when their trades go against them. |

| Cheese 1,374 posts msg #153806 - Ignore Cheese |

8/29/2020 9:32:41 PM To be clear, this is Kevin's snippet of code for an absolute amount of $300 that I would be willing to lose when my trade goes against me |

| Cheese 1,374 posts msg #153807 - Ignore Cheese |

8/29/2020 9:44:21 PM @hmsb4494 If you really want to experiment and make your approach a little safer and timelier, a few good ideas from good members crossed my mind: nibor100 and safetrade seems to like ema(8) snappyfrog seems to like ema(13) mactherivverat's latest choice seems to be ema(5) and ema(13) |

| Cheese 1,374 posts msg #153808 - Ignore Cheese |

8/29/2020 9:58:38 PM @hmsb4494 If you like Guppy and mMA multiple moving averages, two of my favorite GO TO coders are: graftonian and chetron https://www.stockfetcher.com/sfforums/?q=byuser&author=graftonian https://www.stockfetcher.com/sfforums/?q=byuser&author=chetron |

| Mactheriverrat 3,178 posts msg #153809 - Ignore Mactheriverrat |

8/29/2020 11:00:08 PM The EMA 5 day cross above EMA 13 day is a Bullish signal and more possible upside. The EMA 5 day cross below EMA 13 day is a Bearish signal and more possible downside. The EMA 5 day cross the EMA 13 day is from Carolyn Boroden that she's uses at a Bullish / Bearish signal. @Fibonacciqueen on twitter. |

| Mactheriverrat 3,178 posts msg #153810 - Ignore Mactheriverrat |

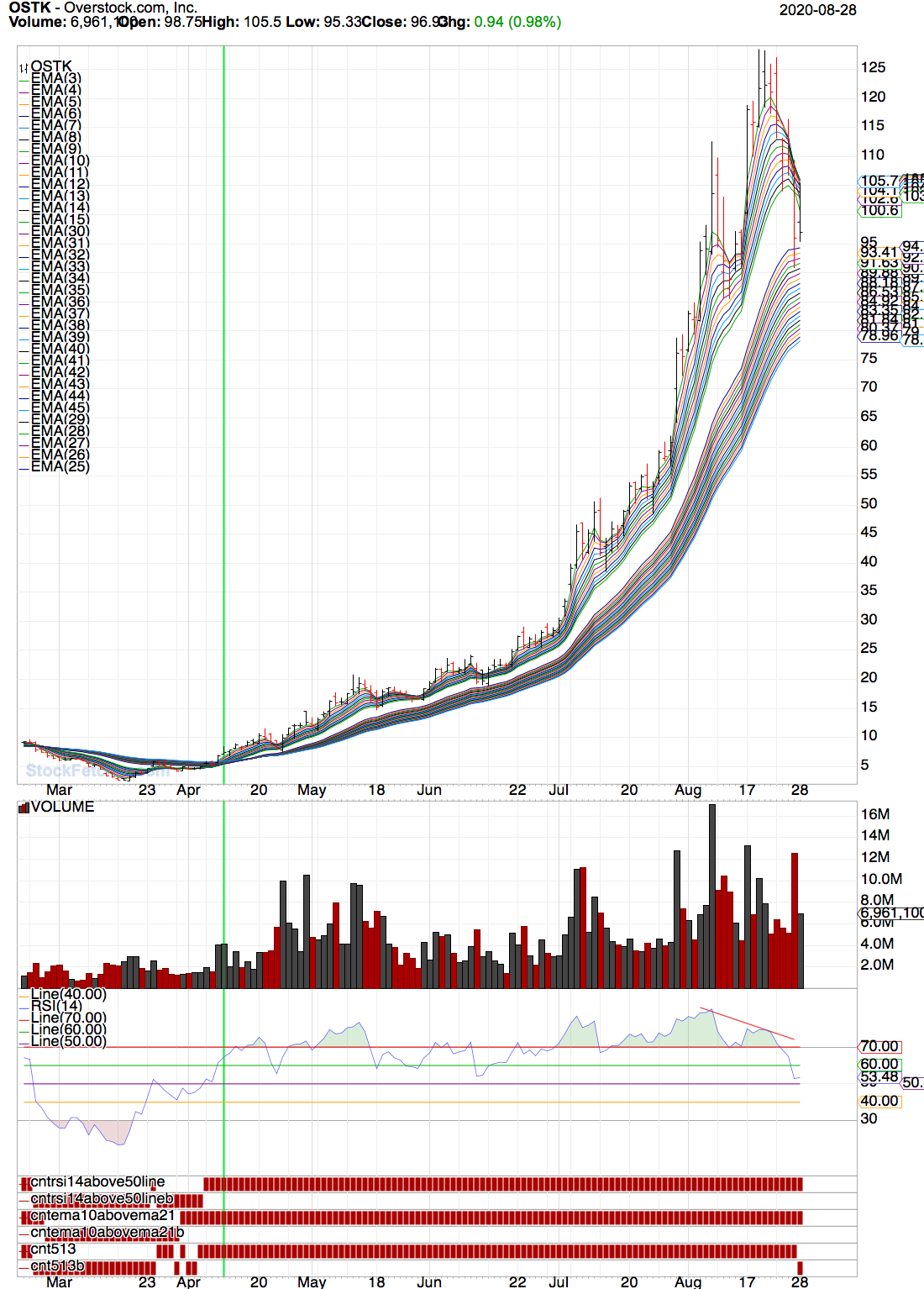

8/29/2020 11:37:27 PM OSTK shows at or near the Buy in point (green line) using Guppy MMA's. RSI(14) above 50.00 line EMA(10) cross above MA(21) EMA(5) cross above EMA(13) Every thing trends up until this past week or so with the RSI(14) showing downtrend weakness and as of Friday the EMA(5) has crossed below the EMA(13) meaning the short term Guppy MMA traders group has or is about to completely rollover. The questions next week will there be more selling pressure from the traders group thus pushing down into the Guppy investors group . Will the RSI(14) drop below 50.00 means the Bullish trend is losing steam.  |

| StockFetcher Forums · Filter Exchange · Need help understanding a line of code | << 1 2 3 >>Post Follow-up |