| StockFetcher Forums · Filter Exchange · Has Anyone Used Inverse ETF’s | << >>Post Follow-up |

| marine2 963 posts msg #159489 - Ignore marine2 |

8/24/2022 10:10:22 PM Has anyone used inverse ETF’s? If so, have you used them more than one day? I have read information from Fidelity that warns anyone that uses an inverse ETF that going beyond one day may get you into trouble because of its volatility. They say it’s not to hold onto very long. If you have used inverse ETF’s could you please let me and others know your experience with them. It’s a good idea to think about using because it could used to provide a safety if you are in the market equity wise and if you could use an inverse ETF to straddle you in case equities went down. |

| nibor100 1,102 posts msg #159493 - Ignore nibor100 |

8/25/2022 2:42:17 PM VectorVest put out a video, on YouTube entitled the "Ins and Outs of Contra ETFs just last weekend on when to purchase Contras and they definitely hold them overnight many times. You'll have to sit thru some VV speak and some history but if you pay close attention you'll see there are proper times to buy them and ways to manage them so they don't reverse on you too badly. Hope this helps some, Ed S. |

| shillllihs 6,102 posts msg #159495 - Ignore shillllihs modified |

8/25/2022 3:35:36 PM Here is the problem with inverse ETFs, yes you can make a lot of money when you hit, but you will have a dozen false alarms that will whittle away at you, costing you a huge cumulative % LOSS…OH YEAH… Solve the false signal issue and you struck GOLD…OH YEAH… |

| marine2 963 posts msg #159497 - Ignore marine2 |

8/26/2022 1:50:38 AM Thank you both for your feedback on this issue. I knew they are volatile and unpredictable by reading the cons about putting money on an inverse ETF. Not sure what I’m missing but when I do back testing on a few of these using a couple of my better filters I use I see nice chart showings like normal non inverse equities. And using Stock Fetchers 1 day, 1 week, 2 weeks, and 1 month backtest feature and the associated numbers it shows as results to seeing how successful it was, you get a feeling it responds like other equities you buy and sell. I think if I do try it I would be only doing it for a short period of time. Like doing a day trade. |

| miketranz 980 posts msg #159504 - Ignore miketranz |

8/26/2022 6:51:02 PM One advantage of using inverse ETF's is you don't need a margin account.On the flip side they are risky,unpredictable,after hours action could hurt you.Like the Shill says,lots of head fakes.Try trading the UVXY if you want to make your head spin.Best,Miketranz.... |

| Mactheriverrat 3,178 posts msg #159505 - Ignore Mactheriverrat |

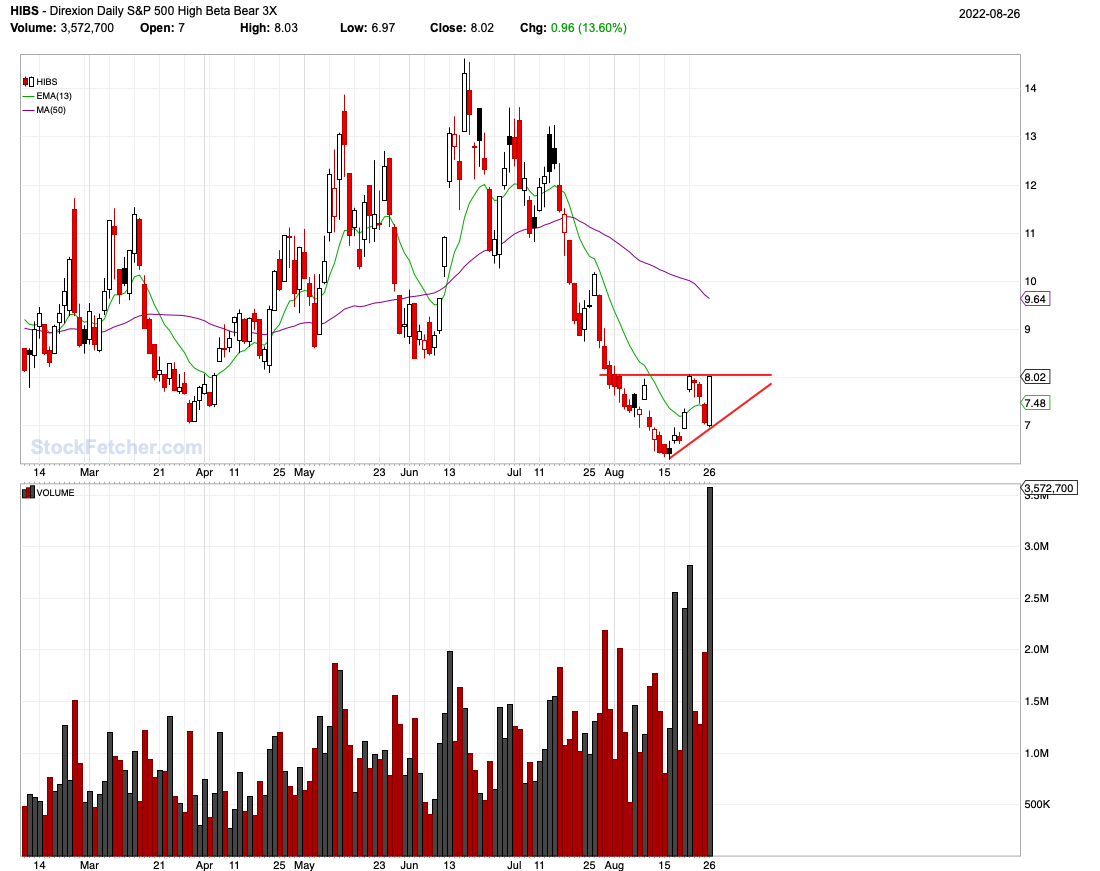

8/26/2022 6:58:51 PM With the current markets appearing to take another dump. I took a position in HIBS. Nice Ascending Triangle setup but hasn't broken out but a big bullish like that says buy with more room to go up. And with Powells comments on interest rates and inflation we could see old support levels tested again in the markets.  |

| Mactheriverrat 3,178 posts msg #159506 - Ignore Mactheriverrat |

8/26/2022 10:16:12 PM Strange thing on ETF's at the end of the day. Sorted by the price change the more from top to bottom. Just in the first page alone just about all had Ascending Triangles near or at breakout status. |

| marine2 963 posts msg #159507 - Ignore marine2 |

8/27/2022 1:19:54 AM These are the Invers ETF’s I checked for how they did on Friday, August 26th, the huge down day for the DOW (down over 1,000 points): SH - 3.31%, PSQ - 4.07%, SBB - 3.00%, SEF - 2.70%, SPDN - 3.32%, DOG - 3.11%, EFZ - 2.64%, SEF - 2.71%, EMTY - 3.42%, MYY - 2.84%, SBB - 3.02%. As you can see doing a day trade with an Inverse ETF when you know the market could be negative for stocks that day. Even though I see these positive %’s here I still might be hesitant in trying one of them. Maybe if I hit the Mega Lottery I might then have some loose change to gamble with. Lol, like we don’t gamble a bit when we trade any ways. |

| StockFetcher Forums · Filter Exchange · Has Anyone Used Inverse ETF’s | << >>Post Follow-up |