| StockFetcher Forums · Filter Exchange · 5% A WEEK FILTER (BASED ON TRO'S CROCK POT) | << 1 ... 23 24 25 26 27 ... 37 >>Post Follow-up |

| jimmyjazz 102 posts msg #113571 - Ignore jimmyjazz modified |

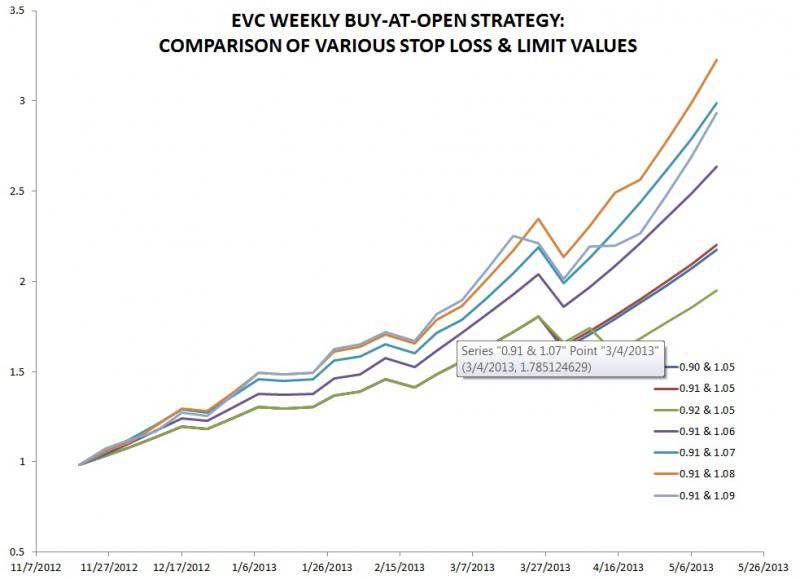

5/21/2013 8:15:56 AM Sorry to resurrect a dormant thread, but I decided to take a look at one specific stock that was caught by this filter and see if I could optimize the stop loss and limit values to maximize compounded weekly returns over the 6-month scan period. The stock is EVC, which was flagged before the open yesterday as having a high reward rating along with low risk, leading to a very high "performance" rating (38). I took the open/close/high/low data and looked at the effects of modifying the 10% stop loss and 5% limit settings. It turns out FOR THIS STOCK that over the past 6 months, one could have done better by using a 9% stop loss along with an 8% sell limit. I assumed that a weekly low below the stop loss triggered the loss, which (I believe) is a more conservative approach than Kevin used in his backtesting. Here is a chart of the various weekly equity curves that came out of this analysis. Thoughts? Is this playing with fire? OK, I need help posting a JPEG file. I tried the [IMG] code but that didn't work. |

| four 5,087 posts msg #113587 - Ignore four modified |

5/21/2013 5:26:18 PM http://www.stockfetcher.com/forums/General-Discussion/How-to-Post-Various-Kewl-Graphic-Stuff-on-SF/53335/0 This site requires no account: http://tinypic.com/ This site requires an email (see below) mktmole 278 posts msg #85968 - Ignore mktmole 1/11/2010 6:34:54 PM SUCCESS ! Here were the steps to post a Chart. Hope this is of benefit to all. 1. Make a Screen Capture of your chart. (Snagit, FastStone Screen Capture, Screen Hunter, Capture WizPro, ScreenPrint, etc) 2. Save your Image to the Desktop 2. Go to http://imageshack.us/ (you can optionally register for free, and this permits you to save your images ) If you do not register, and your image isn't accessed for a year, it is automatically deleted. However, if someone accesses it (even on day 365) the counter is reset, and your image will spend another year on their server. 3. Click Browse and find your saved chart on the Desktop. Select it, and then Open. 4. In Image Shack the chart-link will now appear. 5. Click Upload Now. 6 Followed shortly by "Upload Successful" and a mini image of the chart. 7. Below "Links to Share your Image" look for "HTML Code". Click on this link to highlight and then copy this link. 8. In SF Forums paste the link in your message. When you Preview Message the chart will appear if all is done correctly. |

| jimmyjazz 102 posts msg #113603 - Ignore jimmyjazz |

5/22/2013 6:31:16 PM Yeesh, this is barbaric. Let me try this: |

| jimmyjazz 102 posts msg #113604 - Ignore jimmyjazz modified |

5/22/2013 6:39:26 PM Now, see how a 9% stop loss and an 8% limit order outperformed the other settings for EVC over the last 6 months? If you look at the data, you'll see it causes more holds until close on Friday (where I assumed a sell), but most of those are profitable, anyway, and it turned out to be better to let the winners run all the way to an 8% limit as opposed to cutting them short at 5%. Is this valid theory for a modification of the filter? I don't even know how one would do it, since it requires optimization of every instrument that is flagged. By the way, EVC tripped my 5% limit and closed for a nice profit today. It would not have tripped an 8% limit, and worse, it fell off the cliff after I sold to close at over 12% below my purchase price, so I dodged a bullet there. A 7% limit would have worked, though, so I "left a little on the table". Interesting strategy. |

| jimmyjazz 102 posts msg #114501 - Ignore jimmyjazz |

7/17/2013 6:29:15 AM Can someone tell me how to offset the date so I might find the best stocks to buy on (say) Tuesday open? Wednesday open? etc.? I like this filter, but it often limits out Monday morning. If the math can be run for different starting days, I'd consider playing it again later in the week once a given trade is over. Thanks . . . |

| mlarsen 2 posts msg #114523 - Ignore mlarsen |

7/17/2013 11:12:15 PM kevin-in-ga i have been doing good with your filter ,is there any way you could write it for shorting stocks thanks for all you have done for the rest of us mad monkey |

| lwschultz 13 posts msg #114532 - Ignore lwschultz |

7/18/2013 11:45:29 PM Is there any way to test for how the market did the same week - For example, if a stock went up during specific weeks and the market went up as well those same weeks, then the filter doesn't really tell you anything. I'd really like to know which stocks go up or at least are flat during a week when the market goes down. Is there a way to compare performance of stocks against an index(es) for a given week? |

| Kevin_in_GA 4,599 posts msg #114537 - Ignore Kevin_in_GA |

7/19/2013 8:10:53 AM mlarsen 1 posts msg #114523 - Ignore mlarsen 7/17/2013 11:12:15 PM kevin-in-ga i have been doing good with your filter ,is there any way you could write it for shorting stocks thanks for all you have done for the rest of us mad monkey Please see the short filter version posted on page 4 of this thread. You can modify it as you see fit. |

| Kevin_in_GA 4,599 posts msg #114538 - Ignore Kevin_in_GA |

7/19/2013 8:12:23 AM lwschultz 13 posts msg #114532 - Ignore lwschultz 7/18/2013 11:45:29 PM Is there any way to test for how the market did the same week - For example, if a stock went up during specific weeks and the market went up as well those same weeks, then the filter doesn't really tell you anything. I'd really like to know which stocks go up or at least are flat during a week when the market goes down. Is there a way to compare performance of stocks against an index(es) for a given week? You could use the comparative relative strength function to determine this. |

| jimmyjazz 102 posts msg #114788 - Ignore jimmyjazz |

8/7/2013 2:37:06 PM Any help with this question I posted a while back? ===== Can someone tell me how to offset the date so I might find the best stocks to buy on (say) Tuesday open? Wednesday open? etc.? I like this filter, but it often limits out Monday morning. If the math can be run for different starting days, I'd consider playing it again later in the week once a given trade is over. ===== I have been having fantastic success with this filter. 100% hit rate, and I've even exceeded 5% gains some weeks by timing my entry instead of just jumping in at the open on Monday morning. (I am fully aware that this violates the spirit of the filter, and that I could be compromising performance. Carpe Diem, Caveat Emptor, Semper Ubi Sub Ubi, etc.) |

| StockFetcher Forums · Filter Exchange · 5% A WEEK FILTER (BASED ON TRO'S CROCK POT) | << 1 ... 23 24 25 26 27 ... 37 >>Post Follow-up |